Bank Owned Life Insurance (BOLI) is a tax efficient method that offsets employee benefit costs. The bank purchases and owns an insurance policy on an executive’s life and is the beneficiary. Cash surrender values grow tax-deferred providing the bank with monthly bookable income. Upon the executive’s death, tax-free death benefits are paid to the bank.

BOLI is used as a tax efficient method for offsetting the costs of employee benefit programs. Historically, BOLI was often combined with a new executive benefit plan for senior executives. However in more recent years many banks have added BOLI in order to offset existing employee benefit expenses.

There are three types of BOLI products currently offered to banks:

General Account: This is the oldest form and still the most common product in the market today. When banks make an investment in a general account product the deposit becomes part of the general account of the insurance carrier. Most insurance carriers primarily invest in real estate and bonds. The carrier does not provide specific detail on where they are investing the BOLI proceeds rather they provide some detail of the general account holdings of the carrier. The product has a current crediting rate which can be changed from time to time by the carrier as well as a guaranteed minimum crediting rate that it cannot fall below.

Separate Account: Under this approach the carrier segregates the holdings from their general account into bank eligible investments managed by well-known fund managers. The fund managers provide detailed reporting of the assets within the portfolio. The crediting rate is determined by the carrier using a yield-to-worst ratio. However there is no guaranteed minimum crediting rate. A stable value insurance rider can be purchased in order to smooth out the mark to market performance and provide downside protection.

Hybrid Account: This approach is a combination of the benefits of the above approaches which provide both a current and guaranteed crediting rate of a general account product with the transparency of a separate account product. It should be noted that both separate and hybrid product are not subject to creditors of the insurance carrier providing another level of protection to the bank.

How Does BOLI Work?

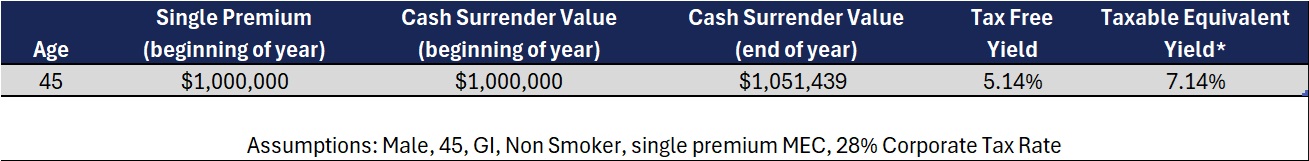

- A bank purchases the life insurance with either a single premium, or a series of annual premiums, on a select group of key employees and/or bank directors. The bank is the owner and beneficiary, although many banks opt to share a portion of the insurance proceeds with the participants. The tax-adjusted cash value growth within a BOLI policy produces a return greater than the opportunity cost, of what the bank would have made in an alternative investment if it had not purchased BOLI. From a compliance standpoint, the BOLI gains are used to offset the costs of the employee benefit programs. Typical BOLI products are single-premium and immediately accretive to earnings, creating an instant positive spread over the cost of funds used to purchase BOLI.

- The accounting for BOLI is governed by FASB Technical Bulletin No. 85-4 and should be recorded on the balance sheet as an “other asset”. The increase in cash surrender or contract value during a specific period, as well as the final net insurance proceeds at maturity, should be recorded as “other income”.

- BOLI is a long term asset when properly implemented and administered, offers the bank a highly-rated investment option with a significant tax advantage versus other bank permissible investments.

*The tax and legal references discussed herein are designed to provide accurate and authoritative information with regard to the subject matter covered and are provided with the understanding that BoliColi is not engaged in rendering tax, legal, or actuarial services. If tax, legal, or actuarial advice is required, you should consult your accountant, attorney, or actuary. BoliColi does not replace those advisors.

Advantages of BOLI

- BOLI is a tax favored asset with returns that typically exceed after-tax returns of more traditional bank investments such as Muni Funds, Mortgage Backed Securities and 5 & 10 Year Treasuries by 150 to 300 basis.

- Cash values grow tax-deferred (tax-free if held until death)

- Death benefits are tax-free

- Ability to efficiently generate gains to offset costs associated with employee benefits programs

- Products institutionally priced and designed specifically for financial buyers

- Immediately accretive to earnings

- Risks that are well within standard business risks in the bank’s investment portfolio

- Well-defined guidance on permissible usage by regulatory authorities

- No surrender charges

- Diversifies investment portfolio

- Ability to immediately increase ROE and ROA

Disadvantages of BOLI

BOLI is considered to be a long term illiquid asset not because of its lack of liquidity, as it can be surrendered at any time without policy charges. However if a BOLI contract is surrendered by the bank the gains within the policy become taxable as well as a 10% IRS penalty on the gain similar to surrendering an IRA prior to age 59 1/2. If the policy is held to the death of each insured, the gain becomes part of the tax free death benefit and no tax is incurred. Assuming the bank is in a profitable position it is unlikely they would wish to pay taxes on the gain unless the liquidity of the asset is needed. In practice, the greatest concerns for most banks is the credit quality of the BOLI carrier. Most carriers in the market are of the highest quality, however, that can change over time. The second concern is the competitiveness of the crediting rate in comparison to the market. To address these concerns, the bank can either surrender the policies and pay taxes or execute an IRC Section 1035 exchange of the policy to another carrier. A 1035 exchange is similar to a tax free IRA rollover. Generally, most 1035 exchanges occur after the tenth policy year as to avoid carrier penalties.